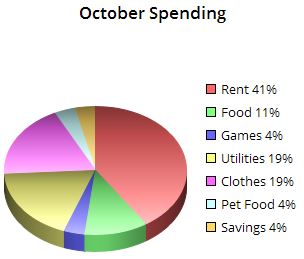

Need help tracking your expenses and actual spending? Want to see your money grow? Try one of these budgeting Apps recommended by Wirecutter for the New York Times. Through rigorous testing they have narrowed it down to two Apps, Simplifi by Quicken and YNAB. The first synchs well with banks, is easy to set-up, and offers an overview of spending. YNAB (You Need a Budget) is more difficult to navigate but records dollar for dollar and may be better for those who want to account for every cent. Both involve a small annual fee. Want to learn more? Read the full article here: The Best Budgeting Apps.

Tag: spending

Honesty in Spending

Have you ever been guilty of making a purchase and not telling your partner? What about buying something and then altering the actual cost when forced to admit your indiscretion?

Many couples fall prey to these kinds of buying practices says Jancee Dunn for the New York Times in her article, Your Cheatin’ Wallet. Read more to see how important it is to move towards total financial transparency with your partner and what pitfalls may arise if you don’t.

To Buy or Not To Buy

How closely do you monitor your personal spending? Are you worried that every cup of coffee may break the bank? Tim Hererra for the New York Times has some great advice and encouragement for you. Check out his article, Here’s Some Money Advice: Just Buy the Coffee, and for more budgeting with “big picture” finance tips try their 7-day Money Challenge.

How closely do you monitor your personal spending? Are you worried that every cup of coffee may break the bank? Tim Hererra for the New York Times has some great advice and encouragement for you. Check out his article, Here’s Some Money Advice: Just Buy the Coffee, and for more budgeting with “big picture” finance tips try their 7-day Money Challenge.

Keeping Your Budget Organized

What tools do you use for your personal budgeting? Ever wonder if you are saving enough to last through retirement or if you have the money for a trip you’ve been wanting to take? What about teaching your children the value of a dollar and how to save, delay gratification when they see an item they want?

What tools do you use for your personal budgeting? Ever wonder if you are saving enough to last through retirement or if you have the money for a trip you’ve been wanting to take? What about teaching your children the value of a dollar and how to save, delay gratification when they see an item they want?Early Retirement?

Do you dream of retiring at 55? Ever thought about what it would take to actually make this a reality? For many it means cutting all extraneous costs such as meals out or travel, but there are other ways to help take a few years off your career. Maya Kachroo Levine for Forbes highlights these strategies to begin in your twenties:

Do you dream of retiring at 55? Ever thought about what it would take to actually make this a reality? For many it means cutting all extraneous costs such as meals out or travel, but there are other ways to help take a few years off your career. Maya Kachroo Levine for Forbes highlights these strategies to begin in your twenties:

–Don’t start spending more because you’re making more

–Start saving more, and maxing out multiple retirement accounts

–Look for side work that you can sustain in the long term

–Focus on owning your home outright

–Find a sacrifice that you’re willing to make that most people deem, “necessary”

–Set up passive income streams.

For more, read her complete article, 6 Steps You Can Take In Your 20s To Help You Retire Before 60.

Have You Written a Money Letter?

Did you know that writing a simple “money” letter to your children will have more of an impact on their spending habits than just telling them your thoughts and feelings about money?

This week, why not think back to your biggest money successes and failures (these are often most helpful), put pen to paper and send your child a note that can have a deep and lasting effect on their lives? If you’re lucky, they’ll listen to your advice and you might even find yourself featured in a book, like Gail Shearer did when her daughter Kimberly wrote the book, Smart Mom, Rich Mom, based on the money letter she received from her mother.

Need advice on just what to say? Check out this article from the New York Times, The Money Letter That Every Parent Should Write.