Need help tracking your expenses and actual spending? Want to see your money grow? Try one of these budgeting Apps recommended by Wirecutter for the New York Times. Through rigorous testing they have narrowed it down to two Apps, Simplifi by Quicken and YNAB. The first synchs well with banks, is easy to set-up, and offers an overview of spending. YNAB (You Need a Budget) is more difficult to navigate but records dollar for dollar and may be better for those who want to account for every cent. Both involve a small annual fee. Want to learn more? Read the full article here: The Best Budgeting Apps.

Tag: budget

Bots vs. Humans

Covid-19 has led some companies to turn to automation to deal with growing demand, closed offices, or budget constraints. But for other companies, the pandemic has provided cover for executives to implement ambitious automation plans they dreamed up long ago.

There’s a new employee in town, R.P.A. (robotic process automation) is beginning to take hold in professions across the board, making life easier for some and costing jobs for others. The workers most at risk for being affected when companies turn to these programs for increased ROI are the highly educated. Read more here: The Robots Are Coming for Phil in Accounting

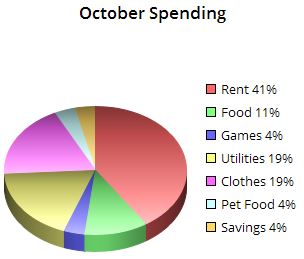

Keeping Your Budget Organized

What tools do you use for your personal budgeting? Ever wonder if you are saving enough to last through retirement or if you have the money for a trip you’ve been wanting to take? What about teaching your children the value of a dollar and how to save, delay gratification when they see an item they want?

What tools do you use for your personal budgeting? Ever wonder if you are saving enough to last through retirement or if you have the money for a trip you’ve been wanting to take? What about teaching your children the value of a dollar and how to save, delay gratification when they see an item they want?The New Pension Plan

With such a variety of retirement plans, many current workers will not have an actual pension. Ann Carrns, for the New York Times suggests a variety of ways to make your savings work for you in her article, No Pension? You Can ‘Pensionize’ Your Savings.

With such a variety of retirement plans, many current workers will not have an actual pension. Ann Carrns, for the New York Times suggests a variety of ways to make your savings work for you in her article, No Pension? You Can ‘Pensionize’ Your Savings.

Her top recommendations include working longer, delaying Social Security payments, and, creating a budget for the amounts that you are required to withdraw from your retirement accounts.

Resolution: Budget

Is one of your New Year’s goals to better manage your money? Do you often find yourself stressed about your budget, or lack there of? Want to make a real go of saving, paying-off debt and creating financial solvency? Stephen B. Smith for Young Money offers nine suggestions to better manage your finances and to achieve your goals. 9 Nifty New Year’s Resolutions .

Is one of your New Year’s goals to better manage your money? Do you often find yourself stressed about your budget, or lack there of? Want to make a real go of saving, paying-off debt and creating financial solvency? Stephen B. Smith for Young Money offers nine suggestions to better manage your finances and to achieve your goals. 9 Nifty New Year’s Resolutions .

May you have health, wealth and happiness in 2017.

Summer Job 101

This article is good because it addresses a range of ages in the “newly employed” category. 5 Financial Tips for Newly-Employed Young People offers these ideas to best utilize money earned:

This article is good because it addresses a range of ages in the “newly employed” category. 5 Financial Tips for Newly-Employed Young People offers these ideas to best utilize money earned:

Save! Save! Save!

Learn to Budget

Get Creative

Avoid Debt

Ask For Help

Advice we should all heed, no matter where we are in our careers.

Spending Plans to Achieve Your Dreams

In this 2013 article by Stacy Johnson, founder of Money Talks News, he shares ways to develop a spending plan for your life that will help drive you toward your goals. Stacy suggests thinking backward to specific, fulfilling experiences and creating your plan of action based on the happy moments in your life. Once you have a clear idea of what you want, the spending plan is no longer about deprivation but about achieving your dreams.

In this 2013 article by Stacy Johnson, founder of Money Talks News, he shares ways to develop a spending plan for your life that will help drive you toward your goals. Stacy suggests thinking backward to specific, fulfilling experiences and creating your plan of action based on the happy moments in your life. Once you have a clear idea of what you want, the spending plan is no longer about deprivation but about achieving your dreams.

How to Develop an Effortless Budget You’ll Stick To

Debt Relief Can Be Simple

Ever considered consolidating your debt in order to make it more manageable? Do you have a list of each of your creditors along with how much you owe? Or have you ever wondered why you don’t have enough on a monthly basis for all the necessities? Then this article is for you! How to Pay off Debt: 6 Steps to Success. Debt relief is a simple process if you form a plan and stick to it and if you need it, I am always here to help!

Ever considered consolidating your debt in order to make it more manageable? Do you have a list of each of your creditors along with how much you owe? Or have you ever wondered why you don’t have enough on a monthly basis for all the necessities? Then this article is for you! How to Pay off Debt: 6 Steps to Success. Debt relief is a simple process if you form a plan and stick to it and if you need it, I am always here to help!

Save Now, Save Later

Up for a challenge? Then give “No-Spend-November” a try. Be part of this new trend and see what it can do for you. The woman featured in the article says it saved her finances and even helped her get on the path to saving for various goals. Just imagine if skipping the takeout for a month could free up the cash to pay-off a credit card or finance that trip you’ve been wanting to take? Would you be willing to try it? You know you want to, so get thinking and stop spending!

Up for a challenge? Then give “No-Spend-November” a try. Be part of this new trend and see what it can do for you. The woman featured in the article says it saved her finances and even helped her get on the path to saving for various goals. Just imagine if skipping the takeout for a month could free up the cash to pay-off a credit card or finance that trip you’ve been wanting to take? Would you be willing to try it? You know you want to, so get thinking and stop spending!