Living wage, minimum wage, fair wage… There are many views on what these phrases mean and how best to apply them in the United States. On Friday, 20 states and 32 cities and counties will raise their minimum wage. In 27 of these places, the pay floor will reach or exceed $15 an hour, according to a report released on Thursday by the National Employment Law Project, which supports minimum-wage increases. How will these increases affect small businesses and workers who may actually stand to lose their jobs because of the new rules? Read more here, Once a Fringe Idea, the $15 Minimum Wage Is Making Big Gains.

Living wage, minimum wage, fair wage… There are many views on what these phrases mean and how best to apply them in the United States. On Friday, 20 states and 32 cities and counties will raise their minimum wage. In 27 of these places, the pay floor will reach or exceed $15 an hour, according to a report released on Thursday by the National Employment Law Project, which supports minimum-wage increases. How will these increases affect small businesses and workers who may actually stand to lose their jobs because of the new rules? Read more here, Once a Fringe Idea, the $15 Minimum Wage Is Making Big Gains.

Employer-Paid Tuition Assistance

Does your employer offer tuition assistance? If so, you may also be entitled to a tax write-off from these loans as well. Eligible expenses often include, books, tuition and fees, as well as supplies and equipment. If you receive more than $5,250 in a year, you must include the excess amount in taxable income. Also, qualified expenses used to justify your employer tuition assistance may not be used toward any other federal education tax benefits. For more information about these benefits, read: Employer-Paid Tuition Assistance.

Does your employer offer tuition assistance? If so, you may also be entitled to a tax write-off from these loans as well. Eligible expenses often include, books, tuition and fees, as well as supplies and equipment. If you receive more than $5,250 in a year, you must include the excess amount in taxable income. Also, qualified expenses used to justify your employer tuition assistance may not be used toward any other federal education tax benefits. For more information about these benefits, read: Employer-Paid Tuition Assistance.

Selling Marijuana, Don’t Forget to Pay Your Taxes

The IRS has dedicated a page on its website to Marijuana sales. Many states have approved the drug for medical uses and some for recreational use, but banks are still discouraged from doing business with these dispensaries and transactions are often made in cash. Even though, just as other consumables, marijuana is subject to taxation and the IRS wants to make it clear to businesses what is expected for paying taxes.

The IRS has dedicated a page on its website to Marijuana sales. Many states have approved the drug for medical uses and some for recreational use, but banks are still discouraged from doing business with these dispensaries and transactions are often made in cash. Even though, just as other consumables, marijuana is subject to taxation and the IRS wants to make it clear to businesses what is expected for paying taxes.

From the site: “The IRS understands this is a new and growing industry and provided frequently asked questions about record keeping, cash payment options, large cash amounts, and other related topics to help promote voluntary compliance in the industry,” said the IRS. “In addition to this page, the IRS also offers a wealth of general small business guidance and resources on IRS.gov.” Want to know more? Visit https://www.accountingtoday.com/news/irs-adds-marijuana-industry-page-to-website

Where did money come from?

Metal coins, paper, crypto-coins, and banking, where did our current money systems originate? Listen to this fascinating podcast from Think, KERA to learn more. “The first writing was just accounting.” Sounds like CPAs invented writing.

Metal coins, paper, crypto-coins, and banking, where did our current money systems originate? Listen to this fascinating podcast from Think, KERA to learn more. “The first writing was just accounting.” Sounds like CPAs invented writing.

The Invention Of Money

Jacob Goldstein, co-host of NPR’s “Planet Money,” joins host Krys Boyd to talk about how our world goes ‘round in large part because we’ve all swallowed hard and agreed to not ask too much about the real value of currency. His new book is called “Money: The True Story of a Made-Up Thing.”

Best Practices Financial Q & A

Ever wonder about the best way to handle certain financial needs? Liz Weston for LA Times Business offers insight into these three situations: hospital bills, home ownership, and retirement savings. Read more for quick tips that can help you make the most of your money. For example, did you know that most hospitals offer financial assistance at low or no interest to patients who qualify?

Ever wonder about the best way to handle certain financial needs? Liz Weston for LA Times Business offers insight into these three situations: hospital bills, home ownership, and retirement savings. Read more for quick tips that can help you make the most of your money. For example, did you know that most hospitals offer financial assistance at low or no interest to patients who qualify?

Here’s why you shouldn’t put that huge hospital bill on a credit card

Business Tax Season During COVID

Thank you to the CPA Journal and Howard B. Levy, CPA for this detailed and helpful article about financial reporting, taxes, auditing and more for businesses as we approach our first tax season amidst COVID. The topics addressed include:

Use of estimates

Risk assessment.

Subsequent Events

Internal Control

Accessibility to Audit Evidence and Client Personnel

Disclosure of Risks and Uncertainties

Accounting Estimates

Valuation of receivables, inventories, investment securities, and deferred tax assets.

Impairment of goodwill, other intangibles, or long-lived assets.

Loss contingency accruals and disclosures.

Business interruption insurance recoveries.

Future operating losses.

CARES Act

Tax effects.

Government loans and other benefits.

Relief for financial institutions from certain GAAP provisions.

Revenue Recognition

Leases and Other Contract Modifications

Debt Covenant Compliance

Inventory Observations

EOM, Explanatory, and CAM/KAM Paragraphs

MD&A and Other Disclosures for Public Companies and Governments

Financial Reporting and Auditing Implications of the COVID-19 Pandemic

Some Practical Guidance

Helping Texas Businesses

Want to know more about what organizations are doing to help small businesses in Texas stay afloat during the time of COVID? Checkout this interview from the Federal Reserve Bank of Dallas with Janie Barerra, founding president and chief executive officer of San Antonio-based LiftFund. Created in 1994, LiftFund has one of the nation’s largest microlending portfolios. The nonprofit provides loans and management training to very small enterprises in Texas and seven other states.

Want to know more about what organizations are doing to help small businesses in Texas stay afloat during the time of COVID? Checkout this interview from the Federal Reserve Bank of Dallas with Janie Barerra, founding president and chief executive officer of San Antonio-based LiftFund. Created in 1994, LiftFund has one of the nation’s largest microlending portfolios. The nonprofit provides loans and management training to very small enterprises in Texas and seven other states.

LiftFund’s Microlending Helps Small Businesses Battle to Survive COVID-19

Discount Shopping at What Cost

Most people have shopped in a dollar store. They are very prevalent and often in places that lack other types of businesses. Even though these stores appear to serve needs for those with little access to retail, a veil of crime and violence hangs over many of the locations in urban areas. With low cost operating plans, these stores may staff only two employees at a time and lack hired security.

Most people have shopped in a dollar store. They are very prevalent and often in places that lack other types of businesses. Even though these stores appear to serve needs for those with little access to retail, a veil of crime and violence hangs over many of the locations in urban areas. With low cost operating plans, these stores may staff only two employees at a time and lack hired security.

The True Cost of Dollar Stores

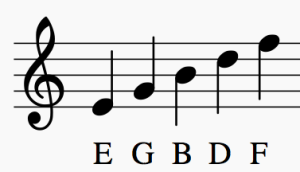

Teach Music Lessons Online

Over the last few months we’ve all adjusted to utilizing Zoom and other online meeting platforms on a daily basis. From business meetings to book clubs, an array of groups have successfully moved their work and socializing online. What about teaching private lessons? Kathy Kristof for the Los Angeles Times reviews Lessonface, an Ap aimed at music teachers of all instruments. Registration is free and commissions/fees are low, 4% for your current students or 15% if they recruit them for you. Check out more about Lessonface here: Review: There’s money to be made teaching music or acting on an app.

Over the last few months we’ve all adjusted to utilizing Zoom and other online meeting platforms on a daily basis. From business meetings to book clubs, an array of groups have successfully moved their work and socializing online. What about teaching private lessons? Kathy Kristof for the Los Angeles Times reviews Lessonface, an Ap aimed at music teachers of all instruments. Registration is free and commissions/fees are low, 4% for your current students or 15% if they recruit them for you. Check out more about Lessonface here: Review: There’s money to be made teaching music or acting on an app.

Midwest Retirement Plans

There are many large companies that brag of their attraction to America’s elite and how the states offer great places for families to live and raise their children. Some even boast of more women as part of the workforce than many other states but do any of these reasons explain why, as retirement plans everywhere have been reduced, Iowa and Minnesota remain on top? Andrew Van Dam for the Washington Post considers these questions and more in, The surprising reasons these Midwest states are the last bastion of retirement plans.

There are many large companies that brag of their attraction to America’s elite and how the states offer great places for families to live and raise their children. Some even boast of more women as part of the workforce than many other states but do any of these reasons explain why, as retirement plans everywhere have been reduced, Iowa and Minnesota remain on top? Andrew Van Dam for the Washington Post considers these questions and more in, The surprising reasons these Midwest states are the last bastion of retirement plans.