The IRS announced in July of 2023 that they would suspend all unannounced visits to taxpayer’s homes and places of business. This decision was made as part of the new IRS Strategic Operating Plan. IRS Commissioner Danny Werfel was quoted about this change, “We are taking a fresh look at how the IRS operates to better serve taxpayers and the nation, and making this change is a common-sense step,” Werfel said. “Changing this long-standing procedure will increase confidence in our tax administration work and improve overall safety for taxpayers and IRS employees.” Read more about this update HERE.

IRS Offers Extra Level of Security with IP PIN

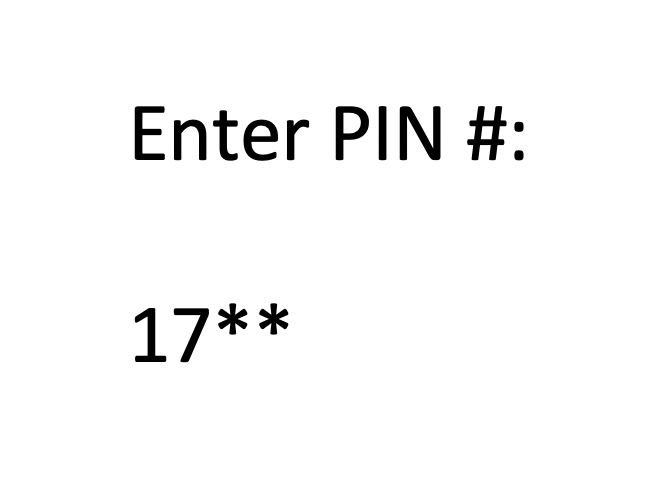

The IRS is offering consumers another way to help protect themselves against fraudulent tax claims and those hoping to steal refund checks. With the IP PIN program, taxpayers may apply for a special code to add second level security to their account. The IP PIN is available to anyone with a SSN or an ITIN (Individual Taxpayer Identification Number). To apply, complete the process below:

The IP PIN process

Here’s how the IP PIN process works:

- Taxpayers wanting to get an IP PIN should go to IRS.gov/ippin.

- Once an individual creates an account and completes the prompted steps the IP PIN will be revealed to them.

- Taxpayers should keep in mind that the IP PIN is only valid for one calendar year. Participating taxpayers must acquire a newly generated IP PIN each January.

Read the full article here: National Tax Security Awareness Week, Day 3: IRS Identity Protection PIN can help avoid fraud and tax-related identity theft

Don’t Miss Out on Tax Refunds

Low to middle income families who are not required to file returns may not be aware they are entitled to certain individual tax credits as well as refunds based on tax withholdings by their employer. Other people who may benefit include, those experiencing homelessness, students new to the work force who may have worked part time, and parents (child tax credit). Learn more here: Not required to file doesn’t mean shouldn’t file

Art Deductions

A new scam aimed at art collectors promises tax deductions and discounted art prices along with special services provided by the dealer. Collectors should beware of aggressive promotions that seem too-good-to-be-true where tax deductions are involved. The IRS has multiple, current investigations involving these high dollar art sales businesses. Read more about claiming donated assets here: Publication 561, Determining the Value of Donated Propertyhttps://www.irs.gov/pub/irs-pdf/p561.pdf#_blank

Gig Economy Tax Questions?

Many who have jobs as part of the gig economy do not realize that all the money they earn is taxable. Even without the official tax forms issued to them. Want to know more and better understand how your side-hustles or part time work, paid in any way, are taxable? Visit the IRS Gig Economy Tax Center and find answers to all of your tax related questions.

Small Business Owner, Have Tax Questions?

Are you a small business owner with tax questions? The IRS offers a great resource to answer all of your inquires and help take the confusion out of starting a business, filing your taxes, adding employees, and much more. They even offer webinars on a variety of business related topics. Check it out today here: Small Business and Self-Employed Tax Center

Savings Goals

According to Ann Carrns for the New York Times Money, Summer is a great time to review your savings goals and adjust as needed. She offers advice from a variety of market professionals as well as best practices to help you successfully reach those goals, even if you’ve fallen behind or failed to start. One simple tip is to print all account statements and highlight frivolous expenses. She also discusses paycheck withholdings, instructions on how to view an online credit card statement, and ways to save more money during the summer on purchases. Read more, Why It’s Smart to Revisit New Year’s Savings Goals Now

Gig Economy Tax Need to Know

What is the definition of gig economy work?

“The term “gig” is a slang word for a job that lasts a specified period of time.” Even though your income is from many smaller jobs, this work is taxable and you should be aware of what you owe at tax time. For more information, reference this article from the IRS website, Gig Economy Tax Center.

Tax Planning Year Round

In this blog post, the IRS recommends ways to keep up with your taxes throughout the year so that when tax time approaches you’ll be prepared and not stressed. A few of the suggestions include, organizing tax records, adjusting check withholding, and saving for retirement. Read more here and start planning for next year’s tax season today. Tax planning doesn’t stop after a taxpayer files a tax return

Financial Challenges of Unmarried Couples

Unmarried and living together? Erik Carter for Forbes walks through the various financial realities of residing with a partner vs. a spouse. From basic money management to estate planning, employee benefits, and tax implications for unmarried couples living in the same home. He compares the monetary pros and cons of domestic partnership and marriage. Unmarried And Living Together? Be Aware Of These Financial Challenges.