During the holiday season, people across our state will gather together and celebrate with friends and family to exchange gifts, offer thanks and reflect on the past year. Many Texans are also expected to buy Christmas trees, bake holiday treats or hit the roads to travel. To commemorate this special time of year, Texas Comptroller Susan Combs has compiled some festive holiday facts about our state and its economy related to the season.

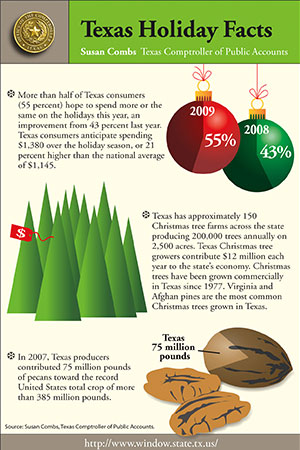

• Texas has approximately 150 Christmas tree farms across the state producing 200,000 trees annually on 2,500 acres. Texas Christmas tree growers contribute $12 million each year to the state’s economy. Christmas trees have been grown commercially in Texas since 1977. Virginia and Afghan pines are the most common Christmas trees grown in Texas.

• In Houston, the city saved $185,000 in landfill costs by recycling 5,800 tons of tree waste from 47,000 homes from October 2007 to September 2008. Seventy-nine tons of this tree waste was from Christmas tree recycling.

• In 2007, Texas producers contributed 75 million pounds of pecans toward the record United States total crop of more than 385 million pounds.

• The Neiman Marcus Christmas Book was first published in 1926. Neiman Marcus is headquartered in Dallas.

• The Collin Street Bakery in Corsicana has been baking the world-famous DeLuxe fruitcake since 1896, the recipe for which was brought over from Wiesbaden, Germany. The bakery ships its Texas fruitcakes, pecan cakes and other delicious pastries to 196 countries.

• In 2008, 5 million Texans traveled during the Christmas and New Year’s season, with 4.5 million traveling by car. Only California had more holiday travelers.

• According to the U.S. Census Bureau, three places in the country are named after the main course of Christmas dinner: Turkey, Texas, was the most populous in 2008, with 456 residents, followed by Turkey Creek, La. (361) and Turkey, N.C. (272).

• According to climate data gathered over the years, Abilene, Lubbock and Wichita Falls have a 3 percent chance of having a white Christmas, and Amarillo has a 7 percent chance of having snow on Dec. 25. The other major cities in Texas have nearly zero chance of a white Christmas.

• More than half of Texas consumers (55 percent) hope to spend more or the same on the holidays this year, an improvement from 43 percent last year. Texas consumers anticipate spending $1,380 over the holiday season, or 21 percent higher than the national average of $1,145.

• Three in four Texas consumers plan to use cash, checks or debit cards to pay for their gifts, compared to 65 percent nationwide. Only 23 percent of Texans expect to use credit cards.

• More than 60 percent of Texans expect to shop at discount/value department stores and 50 percent plan to shop via the Internet.

• Gift cards are expected to be the top gift for the sixth year in a row, with 67 percent of Texas consumers planning to buy an average of six gift cards for presents this year.

During the holiday season, people across our state will gather together and celebrate with friends and family to exchange gifts, offer thanks and reflect on the past year. Many Texans are also expected to buy Christmas trees, bake holiday treats or hit the roads to travel. To commemorate this special time of year, Texas Comptroller Susan Combs has compiled some festive holiday facts about our state and its economy related to the season.

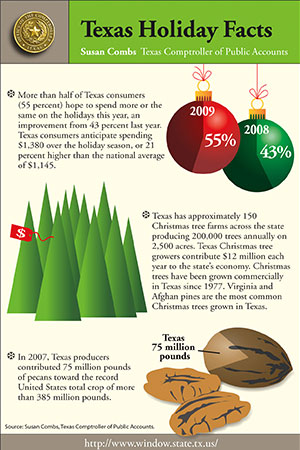

• Texas has approximately 150 Christmas tree farms across the state producing 200,000 trees annually on 2,500 acres. Texas Christmas tree growers contribute $12 million each year to the state’s economy. Christmas trees have been grown commercially in Texas since 1977. Virginia and Afghan pines are the most common Christmas trees grown in Texas.

• In Houston, the city saved $185,000 in landfill costs by recycling 5,800 tons of tree waste from 47,000 homes from October 2007 to September 2008. Seventy-nine tons of this tree waste was from Christmas tree recycling.

• In 2007, Texas producers contributed 75 million pounds of pecans toward the record United States total crop of more than 385 million pounds.

• The Neiman Marcus Christmas Book was first published in 1926. Neiman Marcus is headquartered in Dallas.

• The Collin Street Bakery in Corsicana has been baking the world-famous DeLuxe fruitcake since 1896, the recipe for which was brought over from Wiesbaden, Germany. The bakery ships its Texas fruitcakes, pecan cakes and other delicious pastries to 196 countries.

• In 2008, 5 million Texans traveled during the Christmas and New Year’s season, with 4.5 million traveling by car. Only California had more holiday travelers.

• According to the U.S. Census Bureau, three places in the country are named after the main course of Christmas dinner: Turkey, Texas, was the most populous in 2008, with 456 residents, followed by Turkey Creek, La. (361) and Turkey, N.C. (272).

• According to climate data gathered over the years, Abilene, Lubbock and Wichita Falls have a 3 percent chance of having a white Christmas, and Amarillo has a 7 percent chance of having snow on Dec. 25. The other major cities in Texas have nearly zero chance of a white Christmas.

• More than half of Texas consumers (55 percent) hope to spend more or the same on the holidays this year, an improvement from 43 percent last year. Texas consumers anticipate spending $1,380 over the holiday season, or 21 percent higher than the national average of $1,145.

• Three in four Texas consumers plan to use cash, checks or debit cards to pay for their gifts, compared to 65 percent nationwide. Only 23 percent of Texans expect to use credit cards.

• More than 60 percent of Texans expect to shop at discount/value department stores and 50 percent plan to shop via the Internet.

• Gift cards are expected to be the top gift for the sixth year in a row, with 67 percent of Texas consumers planning to buy an average of six gift cards for presents this year.

Last week Hurricane Harvey swept through Texas and Louisiana leaving destruction in its wake. Now the Atlantic hurricane, Irma is causing great damage to the Leeward Islands with its eye set on Florida.

Last week Hurricane Harvey swept through Texas and Louisiana leaving destruction in its wake. Now the Atlantic hurricane, Irma is causing great damage to the Leeward Islands with its eye set on Florida.