Yes, you. We all should. Some expressions: failure to plan is planning to fail or without a goal, wherever you end up is your goal.

My favorite budget guidelines have always been Larry Burketts, Money Matters , financial planning guidebooks. In the referenced tribute to Larry, his philosophy of money is reflected:

One of the central principles Larry taught is that we don’t really own things; we are simply stewards and managers of what God has entrusted to us.

There are many budget preparation guidelines, but I’ve always liked the ones provided by what is now Crown Financial Ministries. Here is a link to Crown’s Suggested Percentage Guidelines for a Family of 4 (High Housing Cost Areas) (since I live in Austin!). There are also guidelines for singles, single parent, couples, etc.

Important to note is that these budget guidelines start with gross income so that a tithe comes off of gross. No funny business about giving on net or gross. I’ve heard other financial planners say that wherever you give your money, if you can’t live on 90% of your income, you have a problem.

The next reduction is for taxes. If you are an employee, you can use the amount withheld for taxes from your paycheck. Be careful not to have too much income tax withheld. It’s better to pay a $1 than to let Uncle keep your money for up to 16 months! If you are self-employed, you can look at the total tax paid on your prior year return. Taxpayers think that they are saving money, but in fact, saving a little money each month in a savings account generates more savings than the “income tax withheld” savings account. The tendency is to spend that tax refund impulsively rather than putting it into savings for planned spending.

After the reductions for both giving and taxes, then you compute your budget percentages. Your budget is based on your spendable income.

As you complete your budget, remember that many employees have additional reductions in their pay that need to be considered as you budget: health insurance premiums, 401(K) contributions, day care tuition, etc.

I started a 30-Day Diary to really check in with how I spend money on a daily basis. My dad (the first Newby CPA) used to keep a notebook in which he recorded all cash expenditures for the day. What discipline! Join me in the goal of tracking out of pocket expenditures (so to speak!) for 30 days. Let me know how you do.

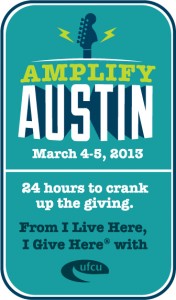

Join the first community wide giving festival through Amplify Austin.

Join the first community wide giving festival through Amplify Austin.