As tax time fast approaches you may have realized that your tax withholding was either too much or not enough. What are the best ways to assure this number is correct for future years? Visit irs.gov/witholding to learn more or watch this short video to get started.

File When Ready

Taxpayers are urged to file their returns when ready and not to wait on Congress and decisions they may make in the coming weeks. Martha Waggoner for the Journal of Accountancy shares more in the article, Don’t wait on action on tax bill to file returns, IRS tells taxpayers. She encourages all taxpayers to not worry about changes from governmental actions and to know that if these do affect individual’s taxes the new guidelines can then be applied to their returns.

IRS Free File

The IRS is again partnering with Free File to offer millions of taxpayers online access to file their taxes at no cost. Want to know if you qualify and how to use this service? Visit IRS.gov/freefile and follow these instructions, listed on the IRS Website.

To find the right IRS Free File product, taxpayers can:

- Go to IRS.gov/freefile,

- Click on Explore Free Guided Tax Software button. Then select the Find Your Trusted Partner tool for help in finding the right product, or

- Use the Browse All Trusted Partners tool to review each offer,

- Select the desired product , and

- Follow the links to the trusted partner’s website to begin their tax return.

Tax Return Professionals

It’s important to use caution when choosing a tax return professional. Although most are knowledgeable and trustworthy, some may be scammers. The IRS offers a comprehensive list of recognized tax service professionals along with those offering specialities.

From the latest IRS Newswire, “The IRS has put together a Directory of Federal Tax Return Preparers with Credentials and Select Qualifications to help individuals find a tax pro that meets high standards. There is also a special page on IRS.gov for Choosing a Tax Professional that can help guide taxpayers in making a good choice, including selecting someone affiliated with a recognized national tax association. There are different kinds of tax professionals, and a taxpayer’s needs will help determine which kind of preparer is best for them.”

Explore our website to see if we fit your needs and send us an email or call if we can help you.

512-484-8016 or debra@nw-cpa.com

Safe Donations

The convenience of online donations makes it simple to give, but also opens the door to criminals hoping to make money using bogus charities. The IRS Newswire recommends using the TEOS to check the legitimacy of any charity you are considering.

From the October, 2023 edition, “Those who wish to make donations should use the Tax-Exempt Organization Search (TEOS) tool on IRS.gov to help find or verify qualified, legitimate charities.

With the TEOS, people can:

- Verify the legitimacy of a charity

- Check its eligibility to receive tax-deductible charitable contributions

- Search for information about an organization’s tax-exempt status and filings”

Sharing your wealth is a great practice, just make sure you are working with reputable groups who are using the money to help those in need.

Unannounced IRS Visits

The IRS announced in July of 2023 that they would suspend all unannounced visits to taxpayer’s homes and places of business. This decision was made as part of the new IRS Strategic Operating Plan. IRS Commissioner Danny Werfel was quoted about this change, “We are taking a fresh look at how the IRS operates to better serve taxpayers and the nation, and making this change is a common-sense step,” Werfel said. “Changing this long-standing procedure will increase confidence in our tax administration work and improve overall safety for taxpayers and IRS employees.” Read more about this update HERE.

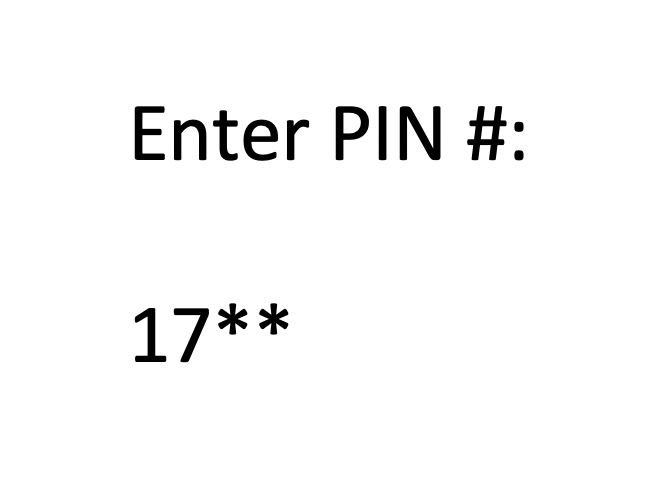

IRS Offers Extra Level of Security with IP PIN

The IRS is offering consumers another way to help protect themselves against fraudulent tax claims and those hoping to steal refund checks. With the IP PIN program, taxpayers may apply for a special code to add second level security to their account. The IP PIN is available to anyone with a SSN or an ITIN (Individual Taxpayer Identification Number). To apply, complete the process below:

The IP PIN process

Here’s how the IP PIN process works:

- Taxpayers wanting to get an IP PIN should go to IRS.gov/ippin.

- Once an individual creates an account and completes the prompted steps the IP PIN will be revealed to them.

- Taxpayers should keep in mind that the IP PIN is only valid for one calendar year. Participating taxpayers must acquire a newly generated IP PIN each January.

Read the full article here: National Tax Security Awareness Week, Day 3: IRS Identity Protection PIN can help avoid fraud and tax-related identity theft

Don’t Miss Out on Tax Refunds

Low to middle income families who are not required to file returns may not be aware they are entitled to certain individual tax credits as well as refunds based on tax withholdings by their employer. Other people who may benefit include, those experiencing homelessness, students new to the work force who may have worked part time, and parents (child tax credit). Learn more here: Not required to file doesn’t mean shouldn’t file

Art Deductions

A new scam aimed at art collectors promises tax deductions and discounted art prices along with special services provided by the dealer. Collectors should beware of aggressive promotions that seem too-good-to-be-true where tax deductions are involved. The IRS has multiple, current investigations involving these high dollar art sales businesses. Read more about claiming donated assets here: Publication 561, Determining the Value of Donated Propertyhttps://www.irs.gov/pub/irs-pdf/p561.pdf#_blank

Gig Economy Tax Questions?

Many who have jobs as part of the gig economy do not realize that all the money they earn is taxable. Even without the official tax forms issued to them. Want to know more and better understand how your side-hustles or part time work, paid in any way, are taxable? Visit the IRS Gig Economy Tax Center and find answers to all of your tax related questions.